irrevocable trust capital gains tax rate 2020

Ad Compare Your 2022 Tax Bracket vs. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050.

Biden Tax Plan And 2020 Year End Planning Opportunities

Further through a so-called portability provision if a spouse dies after 2010 without.

. Because Minnesota taxes resident trusts on all their income and gain and nonresident trusts only pay Minnesota income tax on income properly allocable to Minnesota the implications of these decisions could be significant. However note that Sec. 10 percent of taxable income.

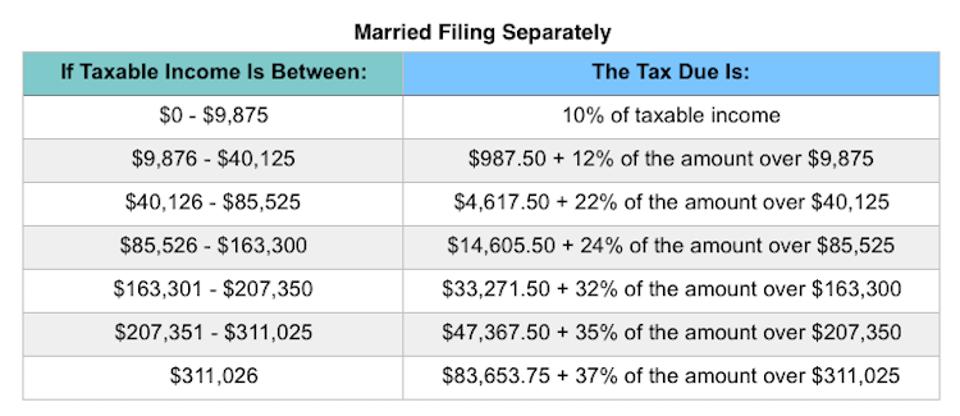

An individual would have to make over 518500 in taxable income to be taxed at 37. Long-term capital gains are usually subject to one of three tax rates. IRS Form 1041 gives instructions on how to file.

Over 2600 but not over 9450. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The rate remains 40 percent.

For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150. It applies to income of 13050 or more for deaths that occurred in 2021. Table of Current Income Tax Rates for Estates and Trusts 202 1.

The tax rate works out to be 3146 plus 37 of income over 13050. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return. The trust has the following 2020 sources of income and deduction.

State tax 2000 Trustee fees 4000 Legal fees 1000. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Inclusion of 20 rate and explanation under paragraph Work out how much Capital Gains Tax is due. A year plus a day isnt really a long time for many investors but its the rule that lawmakers arbitrarily selected. The trustee of an irrevocable trust has discretion to distribute income including capital gains.

If you inherit from a simple trust you must report and pay taxes on the money. Long term capital gain 40000. Your 2021 Tax Bracket to See Whats Been Adjusted.

641 c 2 sets out the specific deductions available to ESBTs. Discover Helpful Information and Resources on Taxes From AARP. For trusts in 2022 there are three long-term capital.

The exemption increases to 11700000 in 2021. During the lifetime of the grantor any interest dividends or realized gains on the assets of the trust are taxable on the grantors 1040 individual income tax return. Interest income 20000.

State taxes are in addition to the above. In situations where the qualified dividends andor capital gains are taxed in multiple tax brackets the program calculates the adjustment for Form 1116 Foreign Tax Credit Line. Trust tax rates are very high as you can see here.

2022 Long-Term Capital Gains Trust Tax Rates. This along with the rate reduction may reduce the tax paid by ESBTs on S corporation income from a maximum of 396 in tax year 2017 to a potential effective rate of 296 starting in tax year 2018 taxable income reduced to 80 times 37 top rate. Ad From Fisher Investments 40 years managing money and helping thousands of families.

In 2020 the federal estate and gift tax exemption is 11580000. Dividends non-qualified 60000. So for example if a trust earns 10000 in income during 2021 it would pay the following taxes.

0 2650. It continues to be important to obtain date of death values to support the step up in basis which will reduce the. Any portion of the money that derives from the trusts capital gains is capital income and this is taxable to the trust.

If an irrevocable trust has its own tax ID number then the IRS requires the trust to file its own income tax return which is IRS form 1041. For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in 2020 the trust could potentially reduce its taxable income to zero for 2019 saving approximately 3150 in taxes the 2019 trust tax rate is 37 for income above 12750. The standard rules apply to these four tax brackets.

In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000. Ad The Leading Online Publisher of National and State-specific Trust Legal Documents. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

In June 2019 the US. The value of a persons estate andor lifetime gifts exceeding the exclusion amount is subject to a 40 estate and gift tax rate. Over 9450 but not over 12950.

Supreme Court issued a unanimous opinion in North Carolina Department of Revenue v. The tax rate schedule for estates and trusts in 2020 is as follows. The highest trust and estate tax rate is 37.

Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. This is typically the case when the trusts distributions for the year exceed the amount of.

For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. 260 plus 24 percent of the excess over 2600.

If taxable income is. The trustee of an irrevocable trust has discretion to distribute income including capital gains.

Recent Developments In Estate Planning Part 1

Tax Form 8949 Instructions For Reporting Capital Gains Losses Capital Gain Capital Gains Tax Tax Forms

Tax Related Estate Planning Lee Kiefer Park

2021 Estate Income Tax Calculator Rates

2020 Estate Planning Update Helsell Fetterman

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Guide To 2021 And 2020 Federal Tax Amounts Bader Martin

Irs Updates Estate And Trust Tax Brackets Exemptions Rates

Dsssb Recruitment 2020 Latest Updates Letsaskme Guest Blogging Recruitment Blog Posts

Do Irrevocable Trusts Pay Capital Gains Taxes Estate Planning In New Hampshire Massachusetts

Biden Tax Plan And 2020 Year End Planning Opportunities

2020 Estate Planning Update Helsell Fetterman

What Are The 2020 Tax Brackets The Motley Fool

Biden Tax Plan Estate Trust Planning Election 2020 New Guide

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Investing In Qualified Opportunity Funds With Irrevocable Grantor Trusts The Cpa Journal

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal